- Venmo for android reviews manual#

- Venmo for android reviews plus#

- Venmo for android reviews series#

- Venmo for android reviews free#

- Venmo for android reviews crack#

Yes, with the introduction of Venmo for Business, processing payment will come with a fee attached. Easy linking between your business account and your personal account, so you can keep sales separate but easily hop between eachĬons of Venmo for Business Venmo Charges a Fee.

Venmo for android reviews free#

The company argues that this is free organic marketing A “business profile” that functions sort of like Venmo’s personal transaction feed.A relatively low rate for card-not-present transactions (1.9% + $0.10 per transaction).There are a lot of great perks, including: We know you’re honest and would refund a client if they accidentally overpaid you, but do you really want to ask someone to send you money with no guarantees? It’s not the ideal customer experience by any means.Īll that said, Venmo has recently expanded into the world of payment processing for businesses. Once someone sends you money via Venmo, that’s it. Venmo bills itself as peer-to-peer payment for good reason: it’s designed for two peers - two friends who trust each other - to easily pay one another. That’s fine, for the most part, but what if they don’t want people to know they’re sneaking off for a massage or haircut on a Tuesday afternoon? Lack of Customer Protection There Are Privacy ConcernsĮver figured out two people you know are dating based on Venmo transactions? (This really can’t just be me.) If a customer or client pays you through Venmo and doesn’t mark it as private, their entire network sees the transaction.

Venmo for android reviews manual#

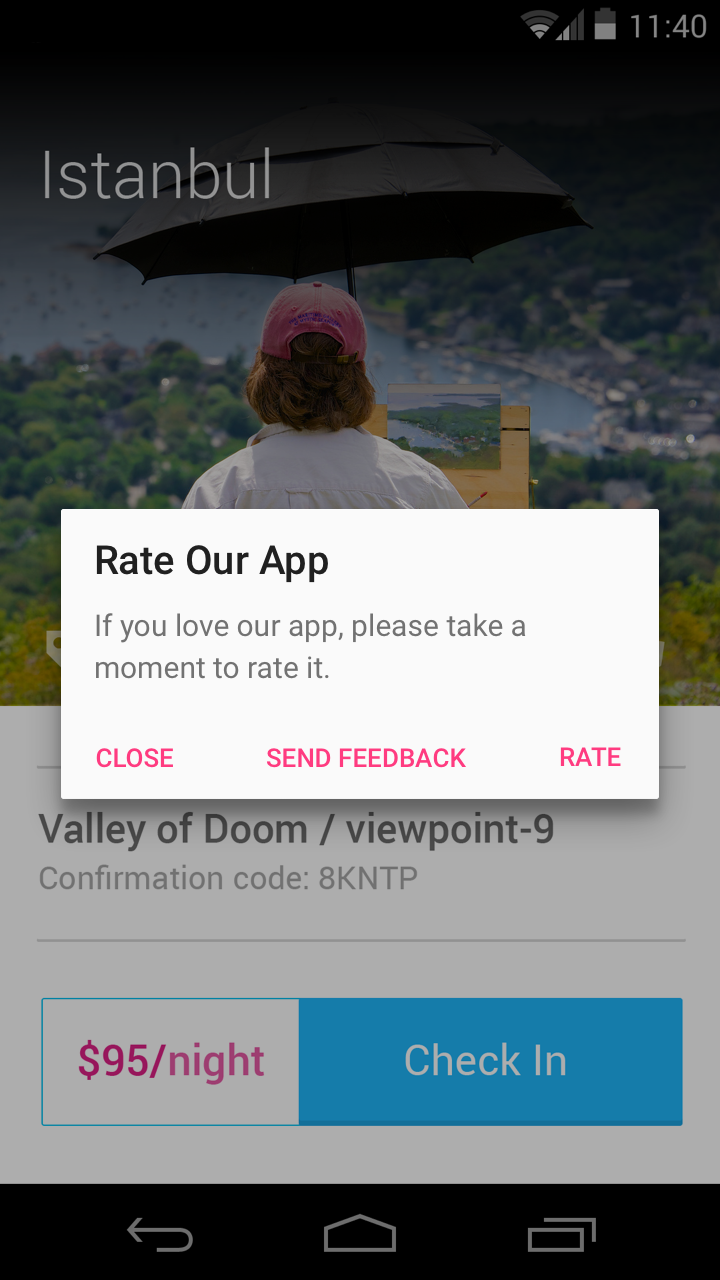

It all adds up to a lot more manual work - and more of a risk of you making mistakes. A client can’t just hit an “add 20% tip” option. Its personal accounts are not designed as an online payment solution for small businesses. for sending money between friends and family. Venmo was built as a peer-to-peer payment app, i.e. Let’s just say we set aside the explicit rules against using your personal Venmo for business payments and that you’re thinking, “But…is it really that bad to use it for business, you know, under the table?” (Of course, you would never think this! We would never assume you would! We just love hypotheticals.) Peer-to-Peer Venmo Doesn’t Have the Features You Need Here’s a great explainer on Venmo’s policy changes and what you should do about it. It appears that Venmo will start enforcing these rules beginning July 21, 2021.

Venmo for android reviews series#

Shortly after its launch of Venmo for Business, the company sent out a series of notifications to Venmo users about new policies and fees for business transactions.

Venmo for android reviews crack#

Venmo Will Crack Down on Businesses Accepting Personal Payments This can make it - ahem - very tempting to use for small business transactions, but it’s not OK with the company. Unlike other payment processors, Venmo doesn’t charge a processing fee (because it’s meant for sending money between friends). Venmo may NOT otherwise be used to receive business, commercial or merchant transactions, meaning you CANNOT use Venmo to accept payment from (or send payment to) another user for a good or service, unless explicitly authorized by Venmo.

/best-payment-apps-4159058-Final_V2-79282cf6babf457faec49a4ae3c068cb.png)

In response to the question, “ Can I use Venmo to buy or sell merchandise, goods, or services?”, the team states: Let’s just get this out of the way before digging in: Venmo explicitly states on its site that you should not use it for business payments. Why You Shouldn’t Use Personal Venmo for Business Payments Venmo Prohibits It

Venmo for android reviews plus#

We’re covering them below, plus what you should do instead if you’re curious about trying a mobile payment app for your business. Using Venmo for your business transactions might seem like a great idea, but there are several reasons why we don’t recommend it. And now, Venmo has announced it’s diving into offering contactless payment processing for small businesses with Venmo for Business. Some small businesses and sole proprietors also use their personal Venmo accounts to accept payments from customers. You likely use Venmo for peer-to-peer payments, i.e. There are various fees for different types of credit card processing - Square here, Stripe there -and that client who still writes you a check after every hair appointment. And then, there’s Venmo.

Let’s be real: accepting payments as a small business owner can feel a little murky. In our Contactless Payment 101 series, we’re breaking down the basics of processing transactions device-free.

0 kommentar(er)

0 kommentar(er)